Chalk Board

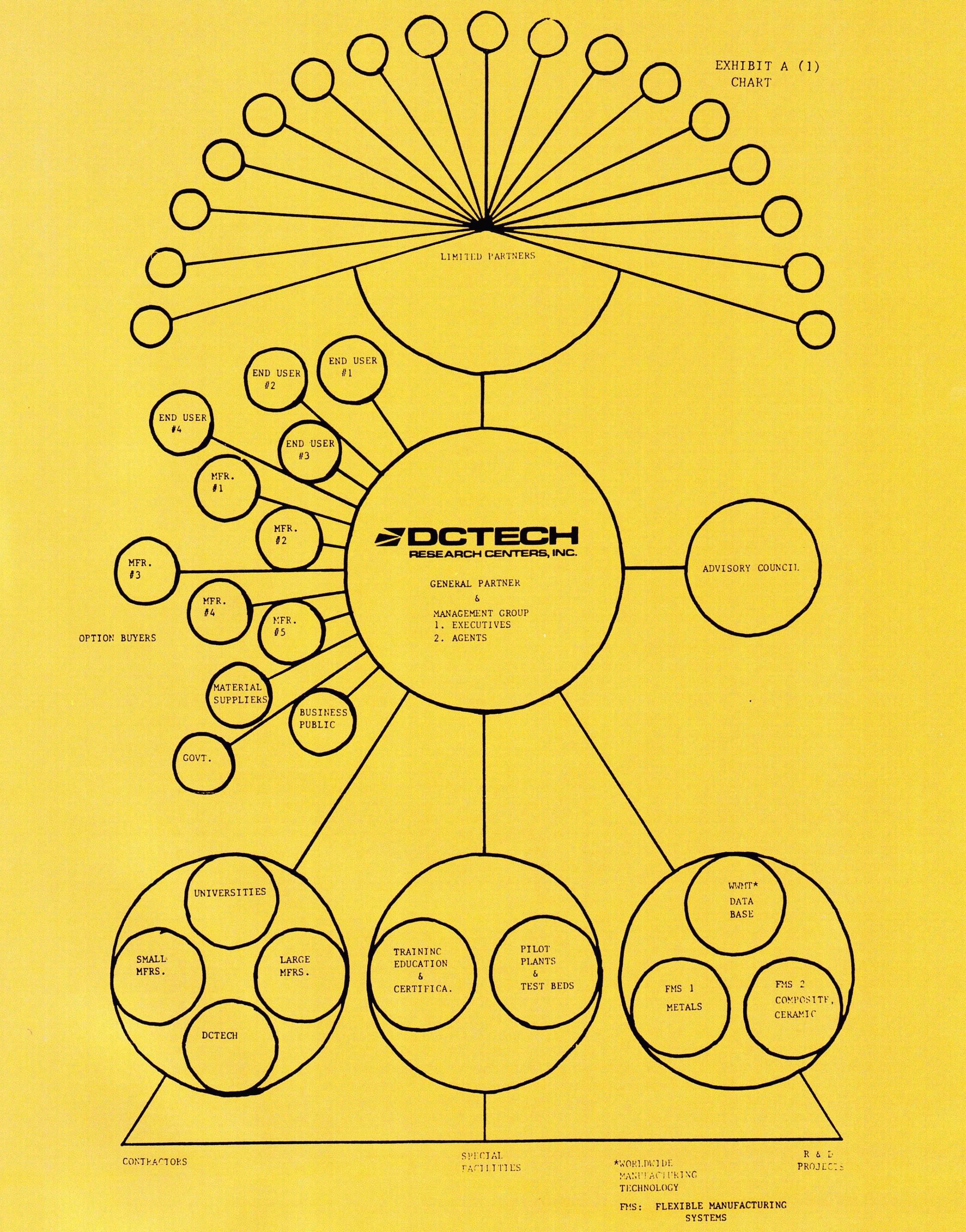

This chart depicts O. Roy Chalk’s expensive — and expansive — plans for a research and development limited partnership centered around the machine-tool industry. It accompanied Chalk’s draft prospectus for DCTECH Research Center Partners, Ltd. Here’s what it means:

General Partner. In the center of the chart is the general partner, DCTECH Research Centers, a wholly owned subsidiary of Chalk’s DC Trading and Development Corporation. Under the terms of the draft prospectus, DCTECH Research Centers would hire itself to carry out the R&D contract for the partnership.

Limited Partners. Chalk would raise $220 million for the DCTECH venture by selling 44,000 units in the partnership at $5,000 apiece; each limited partner would be required to invest at least $25,000. After start-up expenses, an estimated $202 million would be left over for the partnership’s activities (presumably research and development).

Advisory Council. As Chalk envisions it, this council would guide DCTECH in the “selection of technologies and other necessary decision-making operations.” In a separate document, he claims to have enlisted “a top-ranking council of both scientists and engineers as well as a reservoir of more than 100 engineer specialists and a large number of university-affiliated personnel.”

R&D Projects. In carrying out its end of the limited-partnership agreement, DCTECH would seek to develop two fully automated flexible manufacturing systems, one for “conventional metalurgic [sic] materials,” the other for “exotic and composite materials.” It would also try to develop a “worldwide manufacturing technology data base” — a kind of high-tech library on manufacturing science, machine-tool technology, and related hardware and software.

Special Facilities. Chalk’s plans for DCTECH involve at least four facilities that turn out to be located on property owned by subsidiaries of his DC Trading and Development. DCTECH’s far-flung facilities would include one to train, educate, and certify FMS technicians and another to test and demonstrate its prototype FMS.

Contractors. The chart lists four classes of contractors: universities, small manufacturers, large manufacturers, and DCTECH Research Centers. DCTECH would get the sweetest deal; it would, in effect, be signing an irrevocable contract with itself to carry out the partnership’s R&D work.

How much money would flow DCTECH’s way? Virtually all of the offering’s net proceeds ($202 million) plus interest and other investment income.

Option Buyers. DCTECH would have the option to be the exclusive marketing agent for any of the innovative technologies it was able to develop. A group of “option buyers” — manufacturers and end users of machine tools, suppliers of raw materials, and others — would, however, have the right to obtain licenses to the technologies, provided they agreed in advance to pay royalties on them. The amount of the royalties would be determined by DCTECH.

Chalk locks down the best option of all. If his DCTECH gamble pays off in a big way — if DCTECH actually manages to develop innovative technologies with fabulous profit potential — the limited partners could lose their stake at any time, whether they liked it or not. In lieu of being paid royalties by the partnership, they could be bought out for what amounts to their original cash investment.

Main Story: The Man From Yesterday

This article originally appeared in the April 1985 issue of Regardie’s.